In today’s global business landscape, online ratings and reviews have become invaluable tools, influencing 95% of customers before purchasing. However, their importance varies somewhat across European industries, shaped by cultural tendencies and regulatory frameworks.

One key influence is the European Union’s Enforcement and Modernization Directive 2019/2161, also known as the Omnibus Directive. This legislation emphasizes transparency by requiring businesses throughout Europe to be upfront about the customer reviews they display. The directive aims to achieve a three-pronged approach: protecting consumers’ rights and fostering a trustworthy environment where genuine customer voices can resonate.

Trustpilot and London Research joined forces in a report analyzing customer behavior trends based on a survey of 3,000 European consumers across France, Germany, Italy, and the Netherlands (750 per market) to understand how the landscape has evolved since then. Conducted in December 2023, the survey delves into the information sources, and touchpoints consumers utilize throughout the buying journey, explicitly focusing on Trustpilot’s role in their decision-making processes.

By combining these insights, we can better understand how European customers view ratings and reviews in today’s dynamic and consumer-driven marketplace. Some industries stood out more than others in terms of consumer opinion.

Holidays/travel claim the top spot

Like many other industries, the European travel industry is experiencing a post-pandemic resurgence. Global travel reached 84% of pre-pandemic levels in July 2023 (CBI), with Germany and the UK leading the demand for outbound travel.

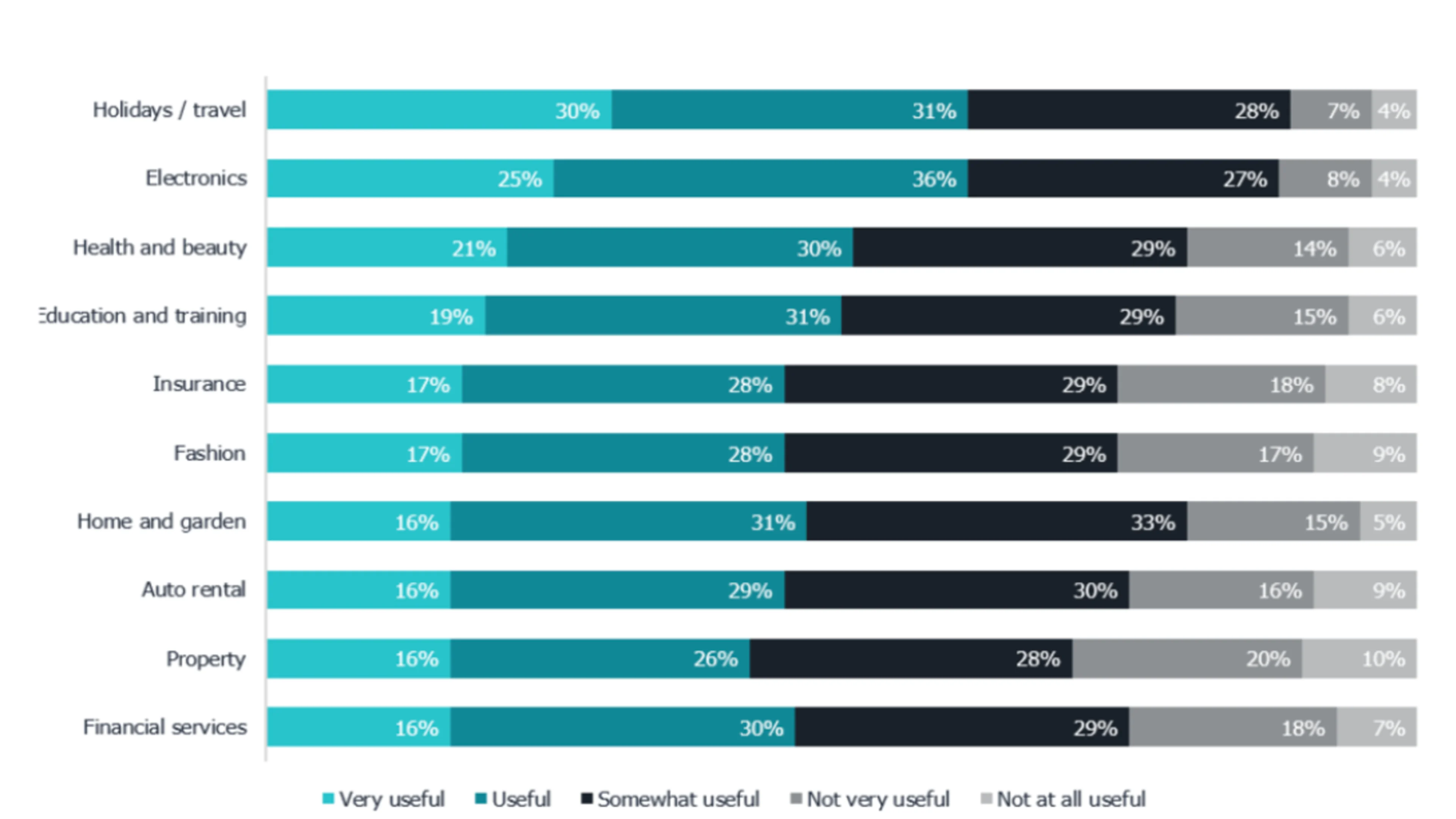

Unsurprisingly, reviews play a critical role in the holidays/travel industry. 30% of European consumers surveyed (3000 participants) considered reviews to be ‘very useful’ in the travel industry, with another 31% finding them ‘useful.’ Meanwhile, only 4% consider reviews ‘not at all useful’ for travel decisions.

This reliance on reviews aligns with the nature of the industry. Much like traditional word-of-mouth marketing, travellers prioritize guest ratings over a hotel’s brand 72% of the time. Honest customer experiences hold significant weight in influencing travel decisions.

The consumer electronics industry in Europe really relies on reviews

The European consumer electronics industry has transformed, with online sales soaring from €434.99 billion in 2020 to a projected €496.4 billion by 2027.

This sector is characterized by constant innovation and product upgrades, with smartphones, tablets, laptops, wearables, and smart home devices increasingly integrating into European life.

In 2022, there were 63.1 million smart homes in Europe, with the number forecasted to reach 112.8 million at the end of 2027, representing a market penetration of close to 47%. Meanwhile, Smartphones have experienced significant growth, reaching a market size of around €75.5 billion in 2023.

Samsung is the top vendor, followed closely by Apple. Consumer electronics companies rely heavily on reviews. The survey results show that 25% of European respondents found reviews in the consumer electronics industry ‘very useful,’ while 36%, the largest percentage of all sectors, considered reviews ‘useful.’

Health and beauty and Home and garden both saw peaks in review usefulness

After holidays/travel and consumer electronics, health and beauty, and home and garden share third place as industries where consumers find reviews the most useful. Interestingly, these two industries are quite different.

Health and beauty consumers are trying to navigate misinformation in the sector. They tend to turn to user-generated content, such as videos from influencers and written content by reviewers.

Within the Home and garden sector, people are mainly worried about spending a large amount of money on bigger items. Social proof gives that sense of safety when buying.

Although certain European home and garden markets may continue to be affected by elevated inflation rates after the pandemic and economic changes in 2022, the European region is anticipated to experience consistent annual growth rates from 2022 to 2027.

Emerging trends such as sustainability and smart products will remain prominent during this period.

Customers within the property industry consider reviews useful but not always

While online reviews hold weight in other industries, their impact is more nuanced in the European property market.

In the US, for example, there is a higher reliance on reviews for residential home services (96%) and real estate agents. This trust in a review community could be attributed to a need for more confidence in real estate agents as the only source of property information. 67.5% of Americans find it difficult to only trust real estate agents.

This contrasts with Europe, where our survey revealed that 10% of respondents consider reviews for property services ‘not at all useful. ' While this is not a huge discrepancy, it was the highest percentage compared to other industries.

This data point highlights a key difference between the two regions: Europeans seem to rely less on reviews in the property market. This can be attributed to a few factors unique to the European environment.

Firstly, information sources beyond reviews could play a more prominent role. Surveyors, title registrations (like France’s cadastre system), and public record searches for older properties are more frequently relied upon. These established systems provide a wealth of historical and structural data that reviews can’t always offer. This makes sense considering the varied ages of European housing stock - 20% of homes in the UK were built before 1919.

While reviews aren’t the sole factor in European property decisions, they shouldn’t be entirely disregarded. Positive reviews of real estate agents can highlight the state of the market, local area expertise and negotiation power. Similarly, reviews of property management companies can shed light on their communication style and maintenance responsiveness. Still, there is a growing appreciation of reviews within the property market; 26% of respondents consider reviews ‘useful,’ which is a good foundation to build on.

Conclusion

While our data may not reveal vast discrepancies, the survey highlights differences in how reviews impact various industries. Fast-evolving sectors like travel and electronics rely heavily on customer reviews due to rapid product iterations and the absence of a standard experience. Though the percentages differed for the property space, reviews are still growing in importance.

The Trustpilot x London Research report covers more than just industry data; it explores the impact of reviews across Europe. Consumer reviews and ratings are a vital part of the buying journey for many people across all European countries surveyed, with around half and three-quarters of respondents considering them as ‘very useful’ or ‘useful.’

This data supports the universal power of reviews to drive business success and build customer trust. We delve further into this concept in the Trustpilot and London Research Report, which is available to read now. Click below.